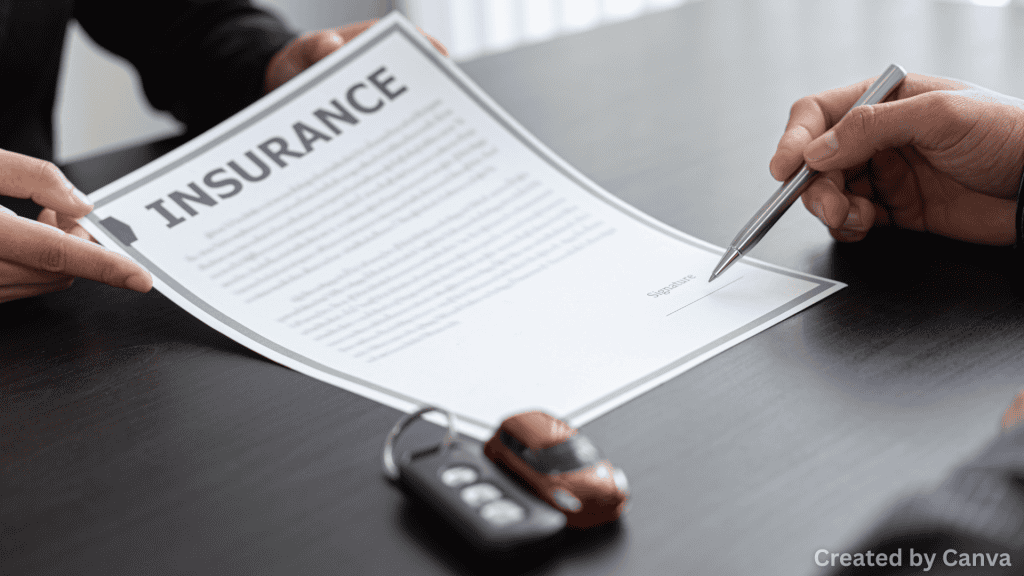

How to Check If Your Car Insurance in Nevada Is Up to Date

The first thing you should do to make sure your car insurance is still in effect is check the policy’s renewal date. Most insurance policies in Nevada renew every year, so it’s very important to remember this date so that your coverage doesn’t run out. If you haven’t gotten a notice to renew your policy […]