Insurance is meant to keep drivers from losing a lot of money, but making a lot of claims can have bad effects. Many drivers in Nevada are shocked to find out how multiple claims affect Nevada insurance rates over time. Drivers can make better choices if they know why insurance companies raise premiums after a lot of claims.

How Insurance Companies Look at the Number of Claims

Insurance companies look at a driver’s claim history to figure out how risky they are. Insurance companies may think that a policyholder is more likely to file future claims if they file a lot of claims in a short amount of time. Even if the accidents are small or not your fault, making a lot of claims can mean that you are at a higher risk overall. This view often causes rates to go up when they are due for renewal.

How Claim History Affects Premiums

One of the most important things that insurance companies look at when setting premiums is the claim history. A clean driving record means you drive carefully and are less likely to get into an accident. Repeated claims, especially for the same problems, show that there is still a risk or a pattern of losses. Over time, this can have a big effect on how Nevada auto insurance costs change when there are multiple claims.

Different Claims Get Different Treatment

Some claims have a bigger effect on premiums than others. Claims for accidents that are your fault and comprehensive claims filed often mean more than a single big claim. If they happen a lot, even small claims can add up. Even when the total payout is low, rates may go up because how often something happens is just as important as how much it costs.

When It Might Not Be Worth It to File a Claim

If the damage is small and close to your deductible, it might be cheaper to pay for it yourself. Not making claims that aren’t necessary can help keep your rates low in the long run. You can make smart choices after an accident if you read your policy and know how claims affect prices.

How to Lower the Chance of Rate Hikes

If you keep driving safely, fix problems with your car as soon as they come up, and only file claims for serious losses, your rates may not go up as much. If premiums go up because of a driver’s claim history, shopping around at renewal time may also help them find better deals.

Questions and Answers

How many claims are too many in Nevada?

There is no set number, but having more than three to five claims in three to five years can be a red flag.

Not at fault claims don’t raise premiums

They can, especially if they show up a lot on your claim history.

How long do claims stay on my insurance record?

Most claims stay on record for three to five years.

Can changing insurance companies get rid of old claims?

No, the driver’s claim history goes with them, not the insurance company.

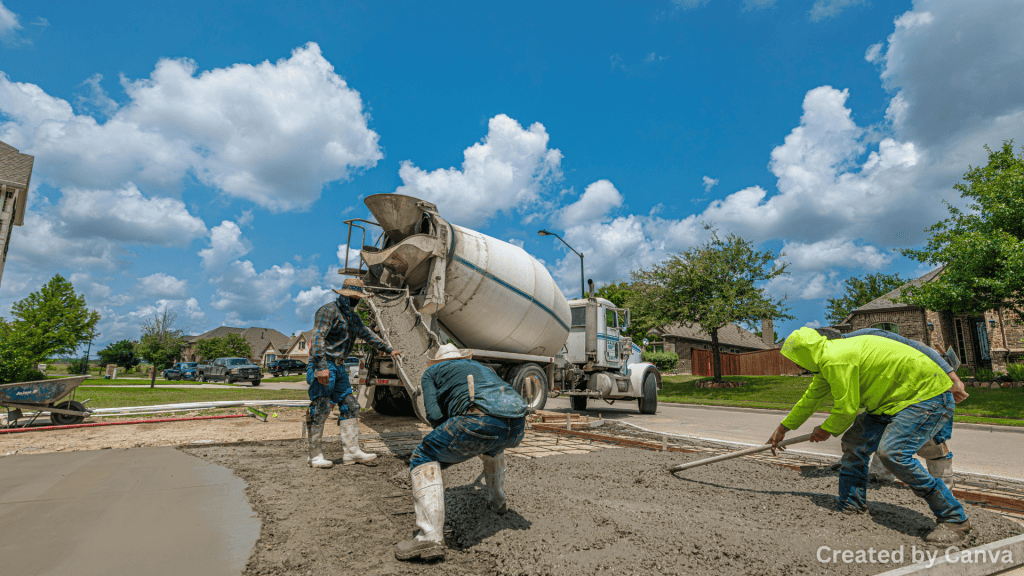

Featured Image

Images are by Canva.com