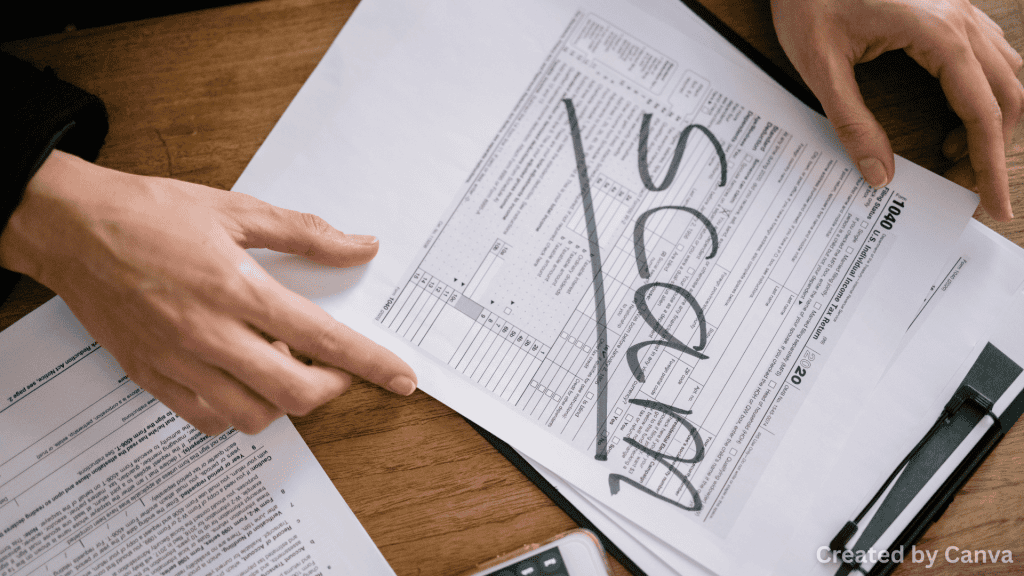

To protect your money and coverage, it’s important to know how to avoid car insurance scams that Nevada drivers face. Scams can happen after an accident, while making a claim, or even when buying a policy. Being aware of fraud is an important part of being a responsible car owner because it can cost drivers money and raise their premiums.

Common Car Insurance Scams in Nevada

One of the most common scams is when drivers stage accidents on purpose so they can file false claims in NV. Some other scams are fake repair shops that charge too much for repairs or people pretending to be insurance agents who ask for personal information. Some scams go after drivers with cheap policies that don’t cover much or anything at all. By recognizing these patterns, drivers can stay alert when something seems off or rushed.

Signs that you might be a victim of insurance fraud

People who sell insurance often use pressure to get you to buy it. If your insurer asks for immediate payment, refuses to give you proof, or tells you to stay away from them, these are all big red flags. Fake adjusters may come out of nowhere or only talk to you through unofficial channels.

How to Keep Yourself Safe

The first step to stopping insurance fraud is to look into everyone who is involved. Always use the official contact information to talk to your insurance company. Keep copies of your policies, claims, and any communication you’ve had. Make sure to write down everything that happened in detail and report it right away after an accident.

Taking care of your personal information also lowers the risk. Don’t give out your policy numbers or ID unless you know the person you’re talking to.

Why you should tell people about scams

If you think you see a scam happening, you should tell someone. This will help keep other drivers in Nevada safe and help the state fight insurance fraud. Sharing information can help stop future problems and make consumer protections stronger, even if no money was lost.

Questions That People Ask a Lot

If you think your car insurance is a scam, what should you do?

Call your insurance company right away, and don’t talk to the person you think is a scammer again.

Can scams in the insurance industry make my rates go up?

If you don’t properly challenge false claims, they can raise your premiums.

Are fake accidents common in Nevada?

They happen, and drivers need to be careful, especially when there is only a small accident.

How can I check the credentials of an insurance adjuster?

Use official contact information from your insurance company to make sure they are who they say they are.

Do you have to report insurance fraud?

Reporting is a good idea and helps keep the whole driving community safe.

Featured Image

Images are by Canva.com

Read more about: How Long Does It Take for Nevada Insurance Claims to Be Processed?