It’s important to know the difference between “no-fault” and “at-fault” insurance rules when it comes to car insurance in Nevada. These two systems decide who has to pay for damages in a car accident. Let’s get into the details of Nevada’s at-fault insurance system and the rules about who is responsible.

Nevada’s At-Fault Insurance

Nevada has an at-fault insurance system, which means that the driver who caused the accident (the at-fault driver) is usually responsible for the damage. This includes costs like car damage, medical bills, and other costs that come up because of the accident. The insurance of the person who is at fault will pay for the damages, but if their insurance isn’t enough, the person who was hurt may have to file a personal injury lawsuit or get money from their own insurance.

Rules About Liability

Nevada’s liability laws say that drivers must have at least a certain amount of liability insurance. This way, if you are found at fault, you will have enough insurance to cover the other driver’s injuries and damages. Nevada’s minimum requirements for liability insurance are:

- $25,000 for each person who gets hurt

- $50,000 for each accident that hurts someone

- $20,000 for damage to property

But these amounts might not always be enough to pay for the whole accident, especially if there are serious injuries or damage.

Take Responsibility

If you’re in an accident, it’s important to figure out who is to blame for the claim. If the other driver is to blame, their insurance should pay for the damage. But if you are found to be at fault, your insurance will have to pay for the other driver’s damages. In some cases, if both drivers are at fault, they split the blame based on how much fault they each have.

Questions and Answers

What is Nevada’s at-fault insurance?

In Nevada, at-fault insurance means that the driver who caused an accident has to pay for the damage they did to other people involved in the accident.

What happens if I am partly to blame for an accident?

Nevada has a rule called “comparative negligence” that says you are partially at fault. This means that the amount of money you owe in damages can be lessened based on how much of the accident you were at fault for.

Do I need more coverage in Nevada?

The state requires drivers to have at least the minimum amount of liability insurance, but many drivers choose to buy more to protect themselves from losing money in an accident.

How do I make a claim in Nevada?

Call your insurance company and tell them about the accident to file a claim in Nevada. They will help you figure out how much damage has been done and who is to blame.

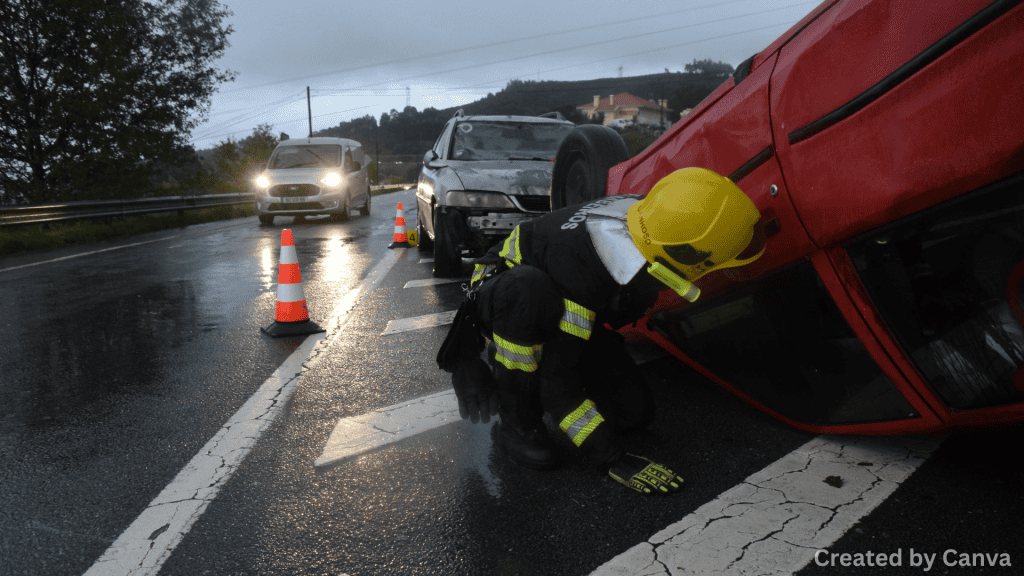

Featured Image

Images are by Canva.com